Bernal Heights Real Estate Market is off to a roaring start!

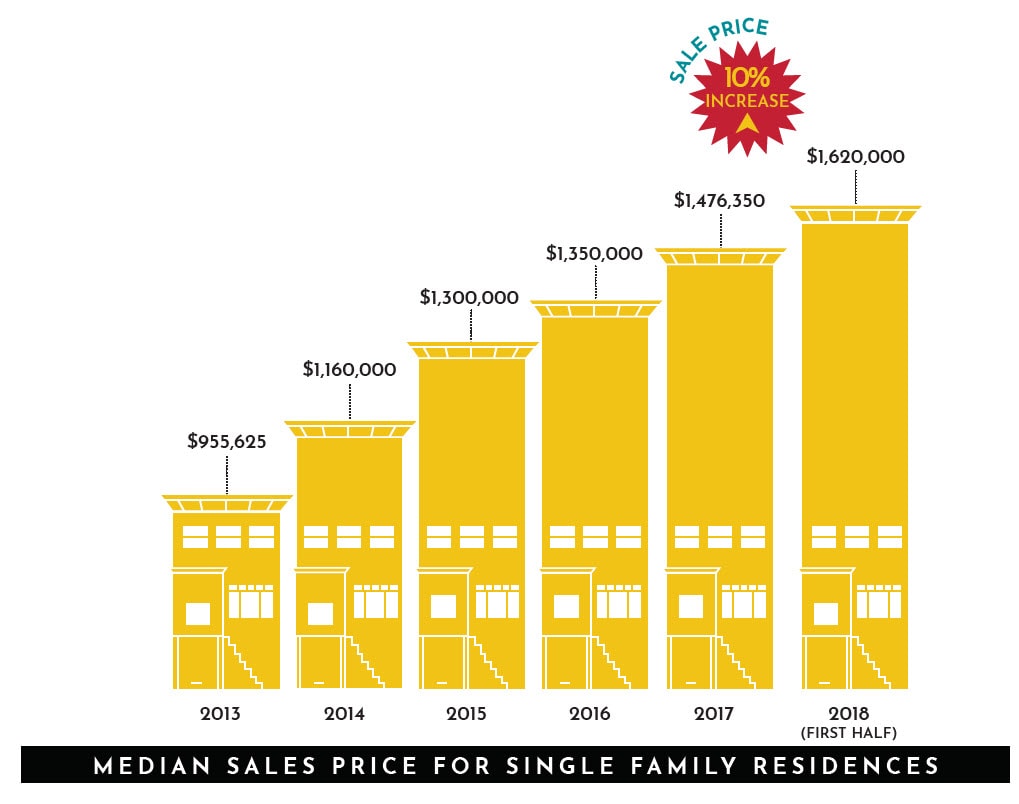

The median sale price for single family homes in Bernal Heights reached an all time high (again) of $1.62M for the time period of Jan thru Jun 2018. That’s 10% over the median for last year of $1.476M. The median price per square foot is now $1,095/ft, a 6.8% gain over 2017. Overbids remain strong with the typical home going for 18% over asking and selling in just 13 days.

The first $2M club member joined 10 years ago at 306 Mullen. Since then, 85 homes have sold in Bernal in the $2M-$3M range. There are now 9 homes in the $3M club! The founding member was 171 Ripley in Jan 2015. 18 Prospect and 160 Bonview seated themselves in May and June this year. SPOILER ALERT: we now have a founding member of the $4M club at 2 Bonview selling for $4.114 in July. This didn’t make the cut for the First Half Market Report which runs thru June, but we couldn’t resist breaking this historic news early. Bernal is now officially a $4M neighborhood, believe it or not.

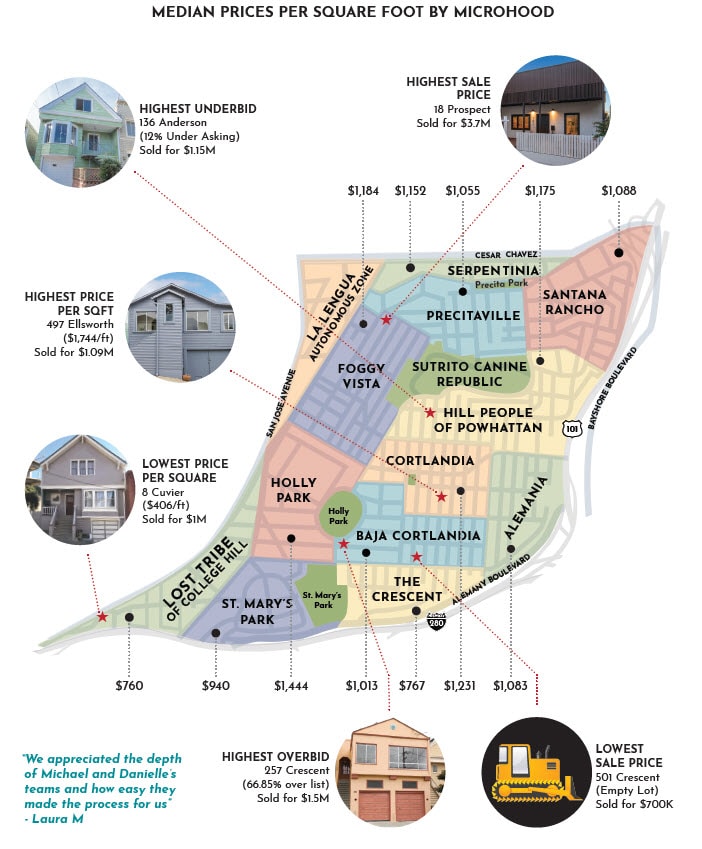

There is a lot of activity happening at the Bernal Heights Microhood level as well. Holly Park saw the highest rate of appreciation on a price per foot basis, reaching a breathtaking $1,444/ft (note the sample size is small at only four homes). The Median Sale Price increased over 30% in three Bernal Microhoods: Foggy Vista fogged up a 33% gain, Lost Tribe of College Hill found 33% growth and Precitaville parked at 39% growth this year.

The outlook for Bernal Heights remains good as long as San Francisco remains strong. There is a chill in the air and it is starting to feel like winter is coming. There is a great deal of macro economic uncertainty around new trade and tariff changes and their impacts on the economy, general political chaos and the changes to the tax code hitting homeowners in April next year. We are keeping an eye on any impacts to jobs and wage growth as that has the greatest impacts on real estate gains.

So far we haven’t seen much impact in the Bay Area, but it seems inevitable that we are due for a correction. Interest rates are approaching 5%, and are already 25% higher than last year. This limits buyers’ purchasing power, which depresses price growth.